MYOB PayPal integration to boost cashflow with digital payments and buy now, pay later for SME customers

The integration is expected to help businesses get paid faster and more securely, improving cashflow and reducing the burden of chasing and waiting for payments.

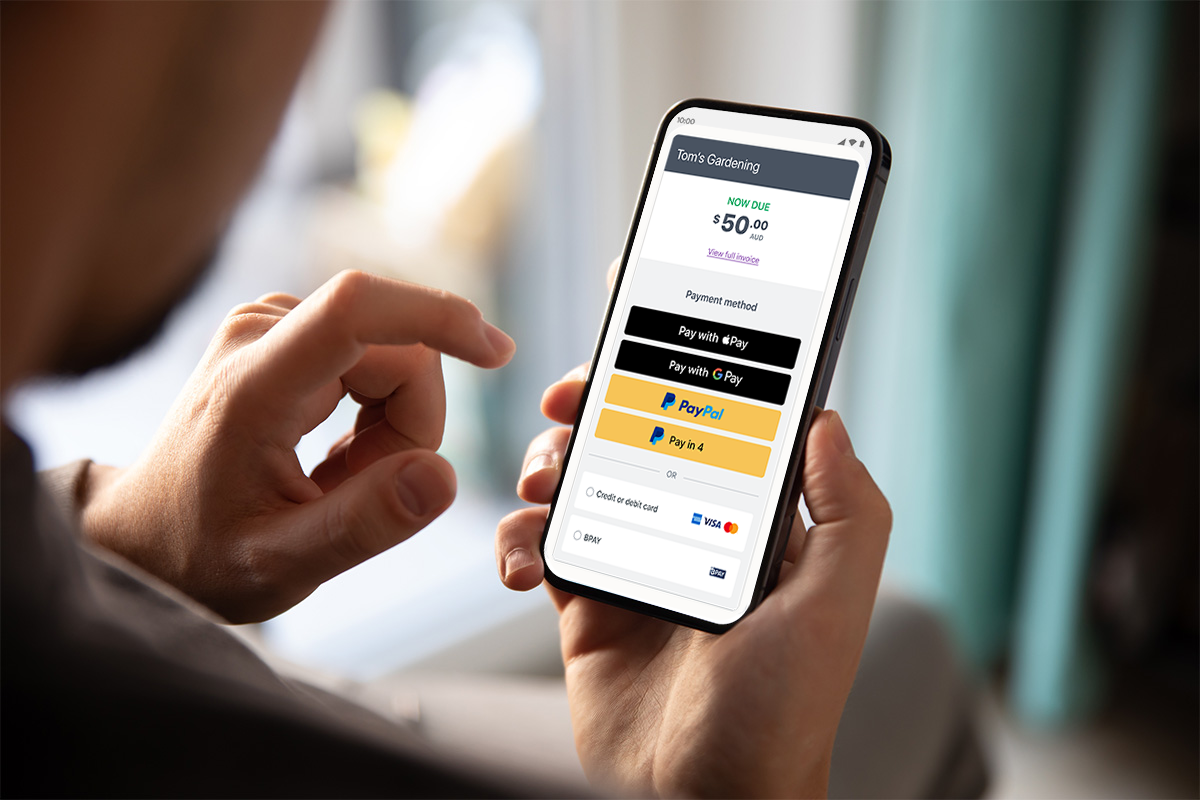

PayPal has today announced that MYOB customers who send invoices with business management platform MYOB can now receive payments made via PayPal and PayPal Pay in 4. This marks the first time a buy now pay later (BNPL) service has been available within MYOB.

Invoicing MYOB customers in Australia will be able to offer PayPal as a payment option, including Pay Pal Pay in 4, with no need to set-up a PayPal account. For MYOB customers who have online invoice payments enabled, invoices will feature buttons for PayPal and PayPal Pay in 4*, allowing payers to pay instantly, or divide the payment over four interest-free instalments, with no late fees.

By increasing convenience and flexibility for customers, the integration is expected to help businesses get paid faster and more securely, improving cashflow and reducing the burden of chasing and waiting for payments.

“Customers expect seamless and convenient payment experiences when shopping online, but that expectation is expanding to anywhere they need to make a payment,” said Jonathan Han, Director, Channel Partnerships and Small Businesses, PayPal.

“Just as we see customers abandon shopping carts when their preferred payment option isn’t available, or when they hit friction in the payment process, many customers will put off paying an invoice if they can’t do so quickly and conveniently with the device they have on hand.”

Research commissioned by PayPal showed almost half of Australian businesses (44%) view cashflow as their greatest challenge[i] and MYOB’s latest Business Monitor Report showed late payments from customers caused pressure for one-in-five (21%) small to medium enterprise (SME) respondents. Two thirds of respondents (66%) said they do not currently offer BNPL, meaning this integration could help many provide the service to their customers for the first time[ii].

Insufficient cashflow can restrict supply and prevent sales, among many other impacts, and almost one third (32%) said they have missed out on more than $10,000 in potential revenue due to lack of cashflowi. This equates to more than $7B[iii] of missed potential revenue nationwide across Australia’s roughly 2.4+ million SMBs.

“Small and medium enterprises face significant economic challenges following a tough few years, so prompt payments and healthy cashflow could not be more important,” said Andrew Baines, General Manager of Financial Services at MYOB.

“Offering the options to pay with PayPal, or PayPal Pay in 4, gives customers every opportunity to pay on time, while improving their experience and deepening their relationship with the business they’re paying.”

* Availability subject to eligibility criteria and terms.

[i] 2022 PayPal Working Capital Research